News Releases

Atico Mining Provides Exploration Update

Vancouver, July 11, 2018 -- Atico Mining Corporation (TSX.V: ATY | OTC: ATCMF)(“Atico” or the “Company”) is pleased to announce the completion of two IP-DAS surveys covering the area from northwestern Archie prospect through the mine to the southern Estrella target area, which have indicated exciting new exploration targets near and below the mine.

Fernando E. Ganoza, CEO, commented: “The exploration work and drilling we have completed since late 2017 have returned encouraging results for the occurrence of massive sulphide mineralization at the El Roble property. These results confirm the need to continue drill testing the anomalous targets and merits scaling-up the drill program for the remainder of the year. We continue to believe the property remains highly prospective to host additional massive sulphide mineralization.”

Exploration Update

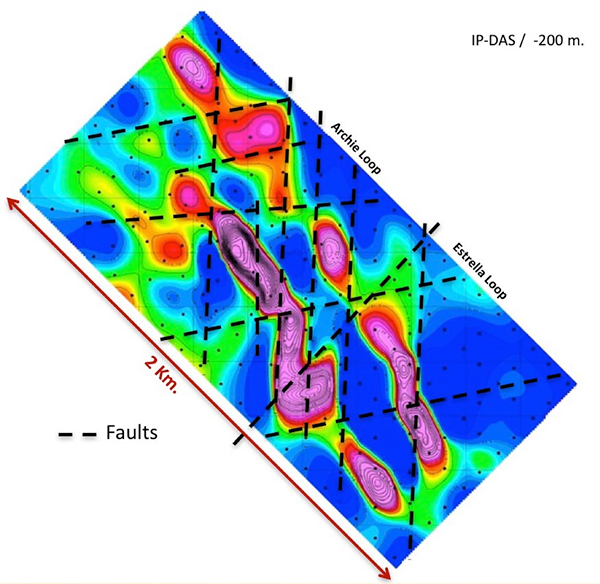

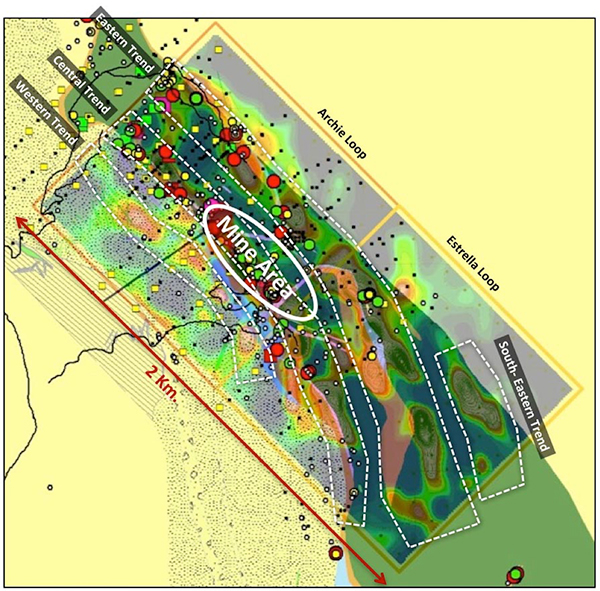

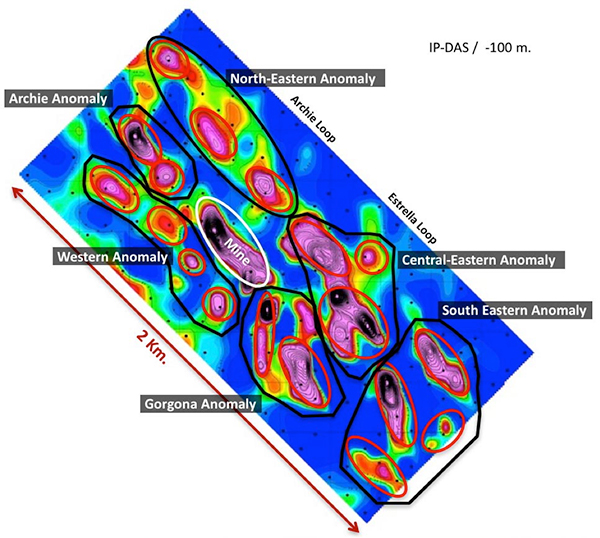

During the first quarter the Company completed 315 stations on 120 channels of IP-DAS geophysics over an area 2 km x 1 km covering an area from the Archie prospect in the north, through the El Roble Mine area and over the Estrella area southeast of the mine. (Figure 1) The IP-DAS has a depth penetration capability exceeding 700 m and has outlined several linear trends of combined chargeability and resistivity anomalies coincident with the mapped “black chert” lithology. These trends are designated as the Eastern trend, the Central or Mine trend, and the Western trend. Each trend contains several, distinct, strong chargeability-resistivity anomalies similar to that expressed over the mine area.

More significantly, the IP-DAS shows an intense anomaly associated with the immediate mine area, which is part of a linear northwest-southeast trend of anomalies coincident with the “black chert” unit. A second, linear trend of anomalies appears coincident with eastern occurrence of the ‘black chert” in the Archie area. The IP-DAS anomalies clearly show fault offsets. The IP-DAS has outlined 6 targets (18 anomalies inside all) on the Mine trend Western and the Eastern trend which warrant drill testing (Figure 2). Of particular significance is a strong anomaly offset by faulting to the SE of the mine workings as well as strong anomalies in the Archie area and Eastern trend. The IP-DAS anomalies in the Eastern and Central trends are coincident with Ag and Zn trace element vector anomalies and narrow massive sulfide intersections.

A major re-interpretation of the structural geology based on recent drilling and surface mapping suggests that the Zeus mineralization is faulted off at depth and the favorable contact geology offset some 140 meters to the east. The IP-DAS data shows similar offsets but also shows the chargeability-resistivity anomaly continuing at depth.

Structural logging of the drill core and integration of the results into the regional mapping program has refined the Company’s understanding of the local structural geology and its relationship to mineralization. The local structure is now interpreted as a southwest verging recumbent fold with the steeper limb hosting the El Roble mine mineralization and the shallower limb cropping out on the east side of the El Roble ridge. The anticlinal fold has been offset by an array of N-S and ENE-WSW faults and NW-SE strike-parallel thrusts, which offset the mineralization by up 140 meters (Figure 3).

The recent drilling clearly demonstrated a thickening of the “black chert” unit over a strike length of approximately 600 meters indicative of a sub-basin favorable for the deposition and preservation of massive sulfides. The sub-basin appears to be bounded by faults which may have acted as feeders for mineralization. The “black chert” unit contains 5-10% bedding-parallel stringers and blebs of pyrite-pyrrhotite suggesting a more distal sulfide depositional environment. Hole ATSA-005, drilled on the northern margin of the sub-basin intersected two intervals of highly anomalous gold (3.9 meters at 2.25 g/t Au from 114.80 meters and 5.3 meters at 2.31 g/t Au from 138.55 meters) supporting the alteration and pathfinder element vectors. The multi-element geochemistry vectors are concentrated with the sub-basin and trend toward the northern margin of the basin.

During Q1-2018, 1,245 meters of underground drilling were completed at the El Roble mine. The Company anticipates that by the end of Q2-2018 the underground drill program will return to the schedule of 3,000 meters drilled per quarter. The program uses one underground rig to test for massive sulfide bodies adjacent to and down-dip of currently known mineralization and to extend the deposit at depth and along strike.

At the Archie target area, approximately 500 meters northeast of the El Roble mine, 1,970 meter of core drilling program was completed in Q1-2018.

A second drill rig is being mobilized to accelerate the testing of IP-DAS anomalies in the Eastern and Central trends. A first program of 5,000 meters of core drilling is planned to test IP-DAS anomalies below and to the southeast of the mine mineralization (Zeus plunge target) and an additional 10,000 meters of drilling is planned to test the Eastern trend where previous drilling following trace element vectors intersected thin massive sulfide mineralization in the “black chert” horizon.

The Company is highly encouraged by these results, which have outlined several strong IP-DAS anomalies within three parallel trends within the “black chert” unit are supported by trace element vectors and a re-interpretation of the structural geology. A program of 15,000 meters in 36 diamond core holes from the surface is planned for the remainder of 2018 and 2019 to test these targets, in addition to the 3,000 meters of underground drilling to test the down-dip ‘Zeus plunge’ target

El Roble Mine

The El Roble mine is a high-grade underground copper and gold mine with nominal processing plant capacity of 800 tonnes per day, located in the Department of Choco in Colombia. Its commercial product is a copper-gold concentrate.

Since obtaining control of the mine on November 22, 2013, Atico has upgraded the operation from a nominal capacity of 400 tonnes per day. The mine has a continuous operating history of twenty-two years, with recorded production of 1.5 million tonnes of ore at an average head grade of 2.6% copper and an estimated gold grade of 2.5 g/t. Copper and gold mineralization at the El Roble property occurs in volcanogenic massive sulfide (“VMS”) lenses.

Since entering into the option agreement in January 2011 to acquire 90% of El Roble, Atico has aggressively explored the mine and surrounding claims. The Company has completed 31,377 meters of diamond drilling and identified numerous prospective targets for VMS deposits on the 6,679-hectare property. This exploration led to the discovery of high-grade copper and gold mineralization below the 2000 level, the lowest production level of the El Roble mine. Atico has developed a new adit access from the 1880 elevation to develop these new resources.

El Roble has a measured and indicated resource of 1.87 million tonnes grading 3.46% copper and 2.27 g/t gold, at a cut-off grade of 0.93% copper equivalent. Mineralization is open at depth and along strike and the Company plans to further test the limits of the resource.

On the larger land package, the Company has identified a prospective stratigraphic contact between volcanic rocks and black and grey cherts that has been traced by Atico geologists for ten kilometers. This contact has been determined to be an important control on VMS mineralization on which Atico has identified 15 prospective target areas for VMS type mineralization occurrence, which is the focus of the surface drill program at El Roble.

Qualified Control

Dr. Demetrius Pohl, Ph.D., AIPG Certified Geologist, a qualified person under NI 43-101 standards and independent of the Company, is responsible for ensuring that the information contained in this news release is an accurate summary of the original reports and data provided to or developed by Atico Mining Corporation. Dr. Pohl has approved the scientific and technical content of this news release

About Atico Mining Corporation

Atico is a growth-oriented Company, focused on exploring, developing and mining copper and gold projects in Latin America. The Company operates the El Roble mine and is pursuing additional acquisition opportunities. For more information, please visit www.aticomining.com.

ON BEHALF OF THE BOARD

Fernando E. Ganoza

CEO

Atico Mining Corporation

Trading symbols: TSX.V: ATY | OTC: ATCMF

Investor Relations

Igor Dutina

Tel: +1.604.633.9022

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

No securities regulatory authority has either approved or disapproved of the contents of this news release. The securities being offered have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the ‘‘U.S. Securities Act’’), or any state securities laws, and may not be offered or sold in the United States, or to, or for the account or benefit of, a "U.S. person" (as defined in Regulation S of the U.S. Securities Act) unless pursuant to an exemption therefrom. This press release is for information purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of the Company in any jurisdiction.

Cautionary Note Regarding Forward Looking Statements

This announcement includes certain “forward-looking statements” within the meaning of Canadian securities legislation. All statements, other than statements of historical fact, included herein, without limitation the use of net proceeds, are forward-looking statements. Forward- looking statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; uncertainty of estimates of capital and operating costs; the need to obtain additional financing to maintain its interest in and/or explore and develop the Company’s mineral projects; uncertainty of meeting anticipated program milestones for the Company’s mineral projects; and other risks and uncertainties disclosed under the heading “Risk Factors” in the prospectus of the Company dated March 2, 2012 filed with the Canadian securities regulatory authorities on the SEDAR website at www.sedar.com

FIGURE 1

FIGURE 2

FIGURE 3